Websites that work as hard as you

We craft high-performing websites that don’t just look great. They drive results. Whether you need a fresh design, better conversions, or an SEO boost, we’re here to make it happen.

What We Do:

Web Design, SEO & Digital Strategy

We take care of the entire digital journey—from strategy and design to development and ongoing maintenance. Whether you’re launching a new site or optimising an existing one, we ensure it performs at its best.

Strategy

Smart Digital Strategies for Long-Term Growth

We tailor digital marketing strategies to your business goals, helping you attract the right audience and drive sustainable growth.

Web Design

Captivating Designs That Convert

Your website should do more than look good, it should guide users toward action. We design with UX and conversions in mind.

Web Development

Fast, Secure & Scalable Websites

Our developers build high-performing websites that load fast, scale easily, and drive results for your business.

Web Maintenance

Ongoing Support to Keep You Ahead

Never worry about security updates, downtime, or performance issues. We ensure your website stays fast, safe, and reliable.

Email Marketing

Turn Subscribers into Loyal Customers

We craft email campaigns and automated flows that turn subscribers into loyal customers, driving engagement and repeat business.

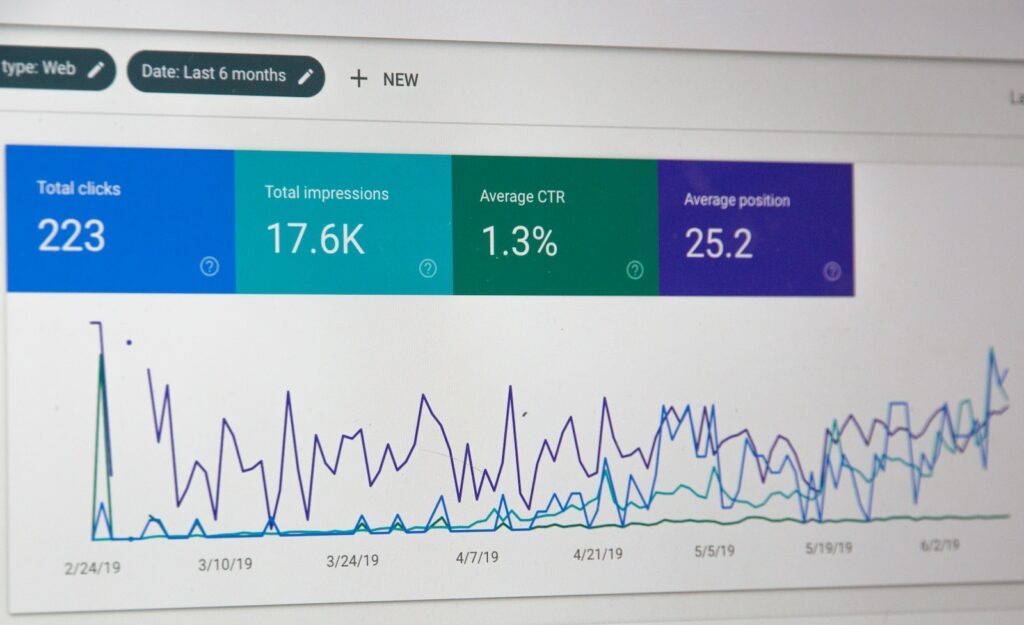

SEO

Get More Traffic & Leads from Google

Rank higher on Google with expert SEO strategies that increase visibility and bring ready-to-buy customers to your site.

Google Ads

Maximize ROI with Targeted Ads

Get the most out of your ad spend with highly optimised PPC campaigns that drive conversions, not just clicks.

Meta Advertising

Social Ads That Drive Sales

Reach the right people at the right time with powerful Facebook and Instagram ads that grow your brand.

Your Website. Your Story.

Your Growth.

Your website is more than just a storefront. It’s your most powerful sales tool. It should attract the right customers, build trust, and drive business growth.

At Smashed Avo, we build websites that work for you. Whether you need a brand-new site or a strategic refresh, we’ll create a digital experience that connects with your audience and delivers results.

Melbourne's finest cakes and desserts.

outdoor enthusiasts.

Exceptional Web Design Services to Elevate Your Brand & Business Growth

Like every brand, your brand has a story to tell, and our web design brings it to life. We highlight what makes you special, so you can attract the right customers and meet your business goals. Our web development services are client-centric, which means every design element is incorporated to inspire growth and help your business thrive in a fiercely competitive market.

What Our Clients Say

I engaged Smashed Avo after months of delays with other providers. They have been collaborative and very helpful with my website, liasing with other people and getting traction on things that have taken months to do but they have had things moving along faster and enablles me to have less to worry about as they seem to be on top of things for my project tasks and activities. Still 10 months to go so will see how things pan out. Looking forward to seeing how things fall into place.

Great service! Very proactive and attentive. They are always on top of the game when responding to requests, especially Clark, who always takes action right away. Thank you for your hard work, John, Clark and the team!

John, Clark & the team have done a great job creating & implementing a new website for us over the past 12 months or so. Their attention to detail, good communication and above all else their prompt response & action to enquiries or unforeseen issues has ensured a smooth process overall.

It's been nearly 10 months since I asked Smashed Avo's help to sort some of the major problems I was facing with my website. In past 10 months they have helped me tremendously to sort all the problems, do the integrations, carry out some of the new projects and as a result of that now my website runs beautifully and effortlessly. Smashed Avo team is of very high caliber and are very caring and are extremely good at problem solving. I highly recommend Smashed Avo for any of your future projects, websites and integrations!!

Smashed Avo is fantastic! They're super caring and always proactive. Their team is amazing, full of endless ideas. Love how they regularly check in. Highly recommend.

John was so invested in our project, I begun to have suspicions that he was a shareholder in the company. Thank you Smashed Avo for your dedication!

We partnered with Smashed Avo for a critical project with tight deadlines and a complex technology stack. The team rose to the occasion and delivered a beautiful, comprehensive website just in time for our launch at PAX Australia. Their exceptional skill and commitment made a significant impact on our marketing plan. We had no issues, and the highlight was seeing our vision come to life through their work. Highly recommend for anyone looking for quality and reliability.

If you're in search of a top-notch website designer agency, look no further!Smashed Avo's expertise in WordPress, WooCommerce, and Shopify websites is truly remarkable. They offer a comprehensive range of services, from website design to development, SEO, CRO, PPC ads, and Meta Ads – everything you need to make your online presence shine.What sets Smashed Avo apart is their exceptional team. They are not only highly skilled but also incredibly ethical in their approach. It's evident that they genuinely care about their clients' success. From the initial consultation to the final result, they go above and beyond to deliver excellence.Their ability to deliver results is unparalleled. They know how to make websites not just visually appealing but also highly functional and optimized for search engines.If you're seeking a website designer agency that combines expertise, ethics, and results, Smashed Avo is the way to go. I wholeheartedly recommend them to anyone in need of web services.Thank you, Smashed Avo, for your outstanding work and dedication to helping businesses succeed online! ⭐⭐⭐⭐⭐

Thrilled to Collaborate With

Crafting bespoke digital experiences to drive growth and delight your customers

Quick Links

Policies

© 2025 SMASHED AVO. ALL RIGHTS RESERVED.